Sustainable Finance

We help you navigate the complex landscape of environmental, social, and governance (ESG) regulation and incorporate sustainable practices into your strategy

Our approach

Sustainable finance refers to the integration of environmental, social, and governance (ESG) criteria in investment decisions, aiming to support sustainable economic growth while minimising negative impacts on the environment and society. Key elements of Sustainable Finance include green bonds, social impact bonds and other financial instruments that incentivise sustainable practices and help the transition to a low-carbon, socially responsible economy.

We believe that sustainable finance is the future of the finance industry. We work closely with our clients, which include banks and fintechs, to help them navigate the complex landscape of environmental, social, and governance (ESG) regulation and incorporate sustainable practices into their strategies.

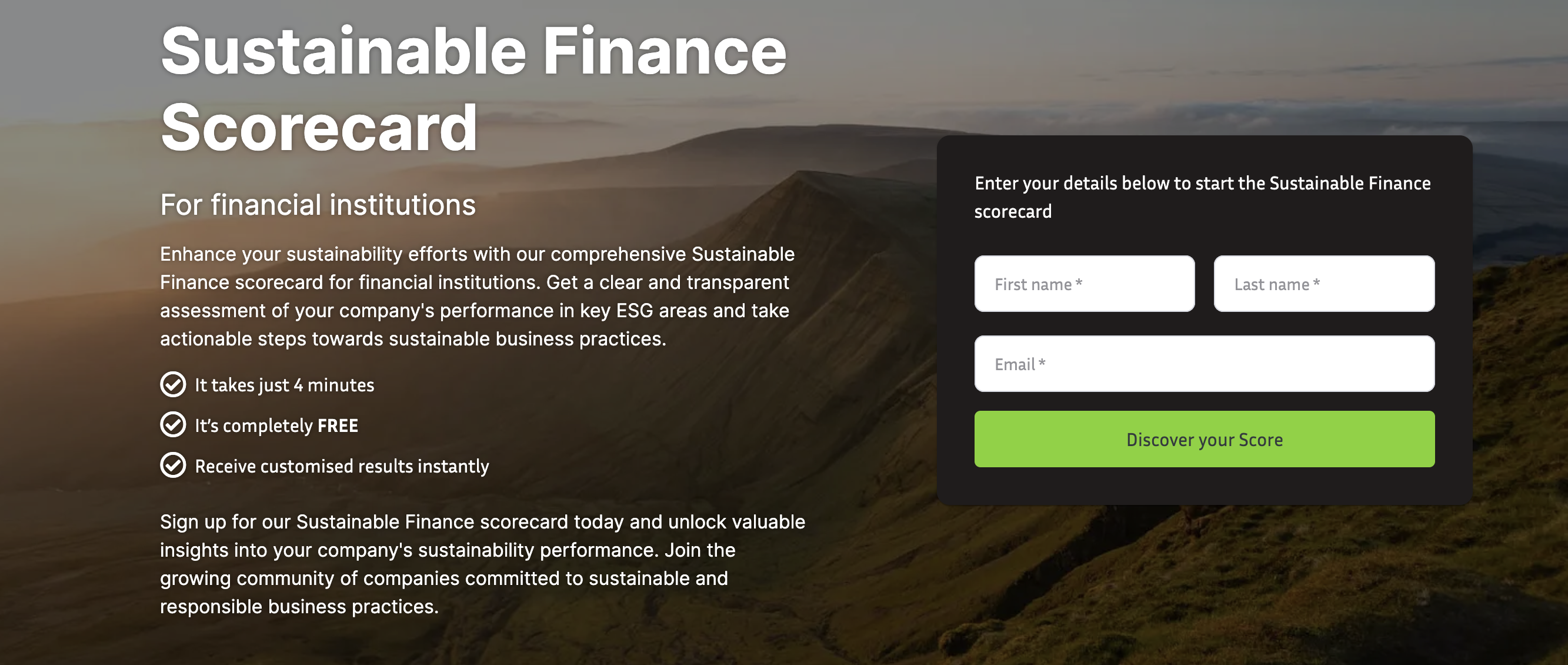

Are you operating a sustainable business?

Our experts can help you gain a better understanding of how to get a clear and transparent assessment of your company's performance in key ESG areas and take actionable steps towards sustainable business practices.

Want to know more?

Start by completing our Sustainable Finance Scorecard to get your personalised sustainability score and unlock valuable insights into your company's sustainability performance.

Common challenges related to sustainable finance

Financial market players and firms face significant challenges in implementing sustainable finance practices, such as complying with ESG regulation, developing sustainable finance strategies and reporting on ESG performance. We work with clients to identify ESG risks and opportunities, develop sustainable investment products, and integrate ESG considerations throughout the organisation. Our technology-led solutions help clients overcome data challenges and provide transparent and accurate data to stakeholders, improving sustainability performance.

How do I comply with ESG-related regulation?

- Disclosure of information on ESG risks in the financial sector is central to achieving the goals laid down in the Paris agreement, and therefore regulation has been developed to ensure transparency and discipline in financial markets

- We have deep expertise in the areas of Sustainable Finance Disclosure Regulations (SFDR), Non-Financial Reporting Directive (NFRD), Corporate Sustainability Reporting Directive (CSRD), Corporate Sustainability Due Diligence Directive (CSDDD), as well as the EU Taxonomy

- We help our clients stay compliant with ESG regulation by providing expert guidance on policy and regulatory changes, as well as developing sustainable finance frameworks and strategies that are aligned with their business objectives

How can I develop a sustainability strategy?

- We work with our clients to develop sustainable finance strategies that create value for their stakeholders and clients

- Our team helps identify ESG risks and opportunities, develop sustainable investment and lending products, and implement ESG integration throughout the organisation

How do I overcome data challenges when reporting on ESG indicators?

- We use technology to help our clients track and report on their ESG performance

- We help our clients to overcome common data challenges (both qualitative and quantitative) using technology led solutions developed together with our partners

- These solutions enable clients to provide transparent and accurate data to stakeholders, comply with reporting requirements, and improve their sustainability performance

How do I stay updated on the latest relevant developments around ESG?

- We write white papers and provide thought leadership on the latest developments in sustainable finance

- Our team stays up-to-date on industry trends and best practices to provide insights and guidance to our clients – read them in Perspectives

Case Studies

Our clients have realised development improvements and transformed their timelines, speeding up their processes.

Unstructured data: ESG news scanner

Using Quantexa to understand your ESG exposure using network analytics

Automating bank-wide climate reporting disclosures

Our sustainability focus areas

We work with financial services organisations on their Sustainable Finance strategy, from the initial inception to the implementation, organisation-wide.

Strategy & leadership

We work with our clients to help them understand what the latest regulation means for their business. We help them define their strategy and align their leadership teams behind a clear and concise approach to climate change.

Supervision

We help our clients prepare for regulatory conversations and embed a risk management framework that supports regulatory requirements and drivers. Our solutions (e.g. horizon scanning) help you maintain oversight of the latest regulations, fines, litigation cases and news.

Implementation

Soon, all activities will require an ESG-focused lens. From designing and implementing an enterprise-wide risk framework to defining core principles and embedding policies within your organisation, we are able to support our clients in their ESG focused implementation.

Data & technology

We work with a variety of cutting-edge and market leading technology companies, with a focus on big data, regulation and compliance. Examples include Quantexa, RequirementOne, Solidatus and Arivu.

Training

Working with the London Institute of Banking & Finance (LIBF), our experts provide executive-level training across the globe.

Our Sustainable Finance partners

NextWave Sustainable Finance Perspectives

.png)

Focus your strategy, set your plan and modernise your business

Our experts

Our team have decades of experience in top-tier global banks and have a proven track record of delivering successful strategy plans and executing business solutions for clients. We are committed to driving forward sustainable finance practices in the industry. We work with our clients and technology partners to create positive social and environmental impact, while also generating long-term financial value.

Interested in digital acceleration?

Subscribe to NextWave for occasional email updates on the latest technology, acceleration approaches, news and NextWave events. You can unsubscribe from these communications at any time.